COLOGNE - A CITY WITH GREAT POTENTIAL

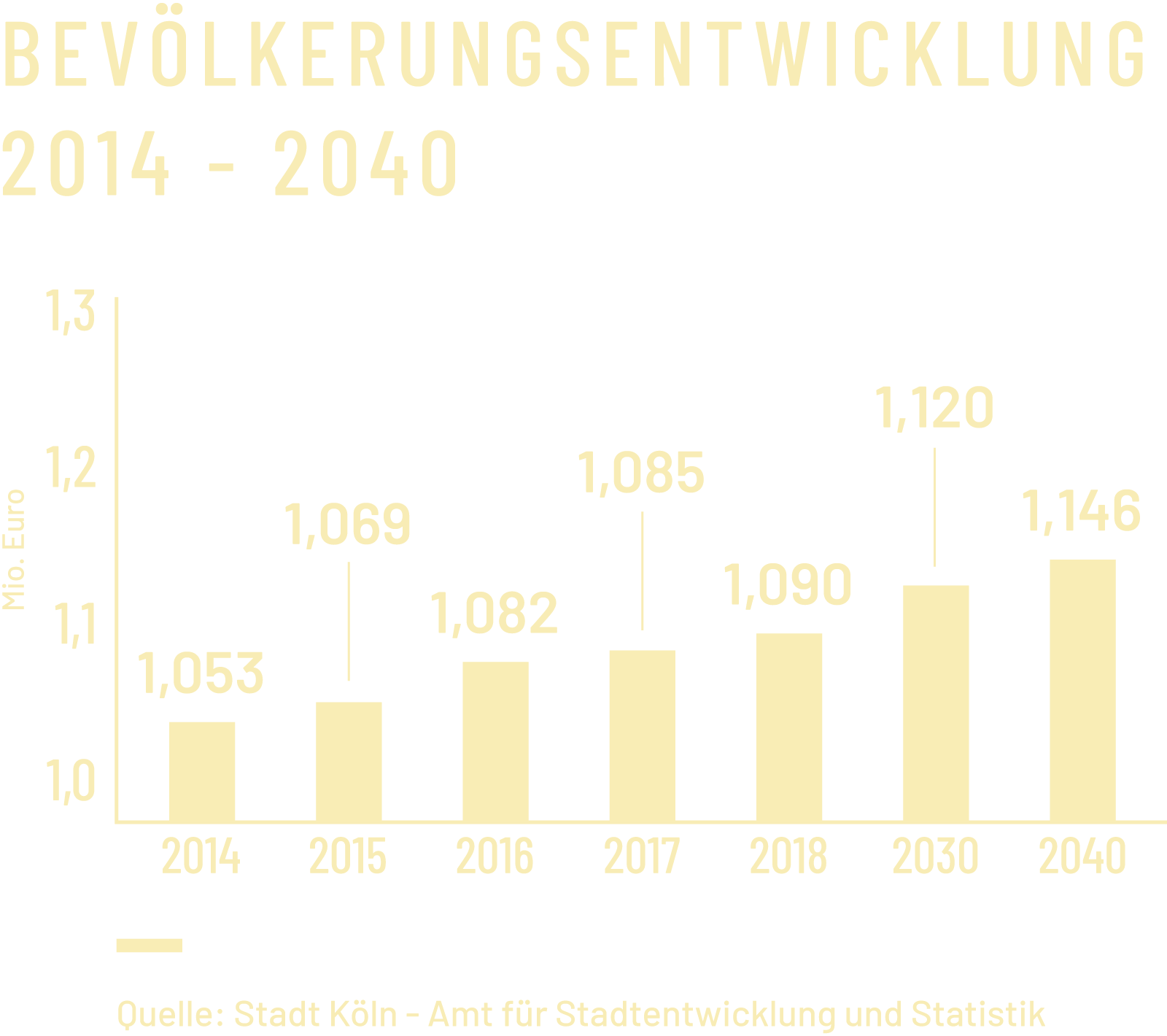

Cologne is a place with a sunny outlook on life and inhabitants who have a passion for their city. The fourth largest city in Germany is 2,000 years old and home to a World Heritage Site in Cologne Cathedral. The city currently has over 1.09 million inhabitants and positive population growth.

Cologne has been home to numerous economic sectors for many years. Notable examples include the chemicals and automotive industries, the media sector, insurance and food retail. Recent developments also indicate that a large number of innovative start-ups are making their way to Cologne, making the city an increasingly important start-up location. Within the last year, the number of start-ups has increased by more than 100 companies. Between May 2018 and May 2019, the number of companies rose from 120 to 225.

The cathedral city is gaining significantly on Berlin and, in terms of the inventiveness and capability of start-ups, is already level with the capital. Cologne is also renowned as a university city. The city currently boasts 24 colleges and four other institutions of higher education, making Cologne the third largest university city in Germany behind Berlin and Munich.

The cathedral city is also a trade fair city. Cologne exhibition centre hosts around 80 trade fairs, exhibitions, guest events and special events in Germany and abroad each year. For more than 25 sectors, these represent the leading trade fairs worldwide. Cologne exhibition centre has exhibition space totalling 284,000 sq m (date: June 2019), making it the third largest in Germany and placing it among the top ten worldwide. The trade fairs and events at Cologne exhibition centre attract approximately 3.2 million visitors.